Encountering issues during the brinksprepaidmastercard.com Card activation process?

We are here with a step-by-step explanation of the brinksprepaidmastercard.com Card activation process!

Read on!

Brinksprepaidmastercard.com Card Activation In 2024

brinksprepaidmastercard.com Card is a prepaid debit card issued by Brink's Home Security. The card can be used to make purchases online, in stores, and over the phone. It can also be used to withdraw cash from ATMs.

To activate your brinksprepaidmastercard.com Card, you will need the following information:

- Your card number

- The card's expiration date

- The card's security code (CVV)

- The phone number associated with your card

You can activate your card online, by phone, or through the Brink's Home Security mobile app.

Activating Brinksprepaidmastercard.com Card via Mobile App

To activate your brinksprepaidmastercard.com Card through the mobile app, follow these steps:

- Open the Brink's Home Security mobile app.

- Tap the “Cards” tab.

- Tap the “Activate Card” button.

- Enter the following information:

Your card number

The card's expiration date

The card's security code (CVV)

The phone number associated with your card - Tap the “Activate Card” button.

Your card will be activated and you will be able to use it immediately.

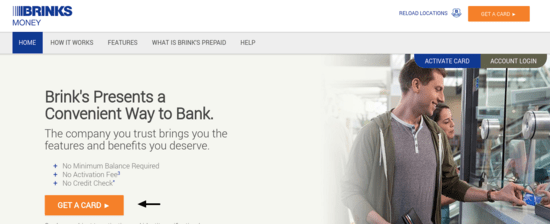

Activating Brinksprepaidmastercard.com Card Online

To activate your brinksprepaidmastercard.com Card online, follow these steps:

- Go to the Brink's Home Security website.

- Click on the “Activate Card” link.

- Enter the following information:

Your card number

The card's expiration date

The card's security code (CVV)

The phone number associated with your card - Click the “Activate Card” button.

Your card will be activated and you will be able to use it immediately.

Common Errors During Brinksprepaidmastercard.com Card Activation

Despite the straightforward process, users may sometimes encounter errors during card activation. These issues can range from input errors to technical glitches. Here are some common problems and their solutions:

- Incorrect Card Details: Ensure all entered details are accurate. Double-check your card number, expiration date, and CVV.

- Technical Issues: If the website or app is not responding, try clearing your browser cache or reinstalling the app.

- Activation Denied: This could be due to various reasons including security concerns. Contact Brink's customer service for assistance.

- Network Problems: A stable internet connection is required for online activation. Check your connection if you encounter delays or failures.

Conclusion

Activating your brinksprepaidmastercard.com Card is a crucial step to access its full range of benefits. Whether you choose to activate it through the mobile app or online, the process is designed to be quick and user-friendly.

Should you face any issues during activation, the common errors and solutions provided can help troubleshoot most problems. Remember, a successful activation brings you a step closer to a convenient and secure financial experience.

FAQs

What is a brinksprepaidmastercard.com Card?

A brinksprepaidmastercard.com Card is a prepaid debit card issued by Brink's Home Security. The card can be used to make purchases online, in stores, and over the phone. It can also be used to withdraw cash from ATMs.

How do I activate my brinksprepaidmastercard.com Card?

You can activate your brinksprepaidmastercard.com Card online, by phone, or through the Brink's Home Security mobile app.

What information do I need to activate my brinksprepaidmastercard.com Card?

To activate your brinksprepaidmastercard.com Card, you will need the following information:

- Your card number

- The card's expiration date

- The card's security code (CVV)

- The phone number associated with your card

What if I have trouble activating my brinksprepaidmastercard.com Card?

If you are having trouble activating your card, you can contact Brink's Home Security customer service for assistance.

What are the benefits of using a brinksprepaidmastercard.com Card?

There are many benefits to using a brinksprepaidmastercard.com Card, including:

- No credit check is required

- No monthly fees

- No foreign transaction fees

- The ability to set spending limits

- The ability to receive alerts for your card activity