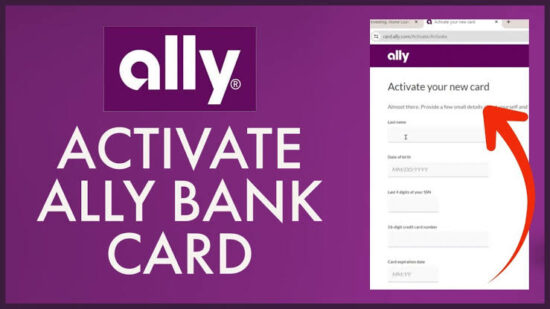

Encountering issues during the ally.com Card activation process?

We are here with a step-by-step explanation of the ally.com/activate process.

Read on.

Ally.com Card Activation In 2024

The ally.com card, issued by Ally Bank, stands out in the financial market with its attractive offerings. In 2024, the card continues to offer a 0% intro APR on purchases and balance transfers for the first 15 months, followed by a variable APR of 14.99%-24.99%.

Additionally, new cardholders can earn a $200 sign-up bonus after spending $1,000 within the first 90 days. Activating your ally.com card is crucial to start enjoying these benefits and managing your financial transactions effectively.

Activating ally.com Card via Mobile App

To activate your ally.com card through the Ally Bank mobile app, follow these simple steps:

- Open the Ally Bank mobile app.

- Tap the “Menu” icon in the top left corner.

- Select “Cards”.

- Choose the “Activate Card” option next to your ally.com Card.

- Enter the 16-digit activation code from the back of your card.

- Confirm by tapping “Activate Card”.

This method is highly recommended for its convenience and speed. The app not only facilitates easy activation but also offers a seamless interface to manage your card settings and transactions.

Additionally, the mobile app provides real-time notifications for your transactions and security alerts, enhancing the safety and management of your financial activities.

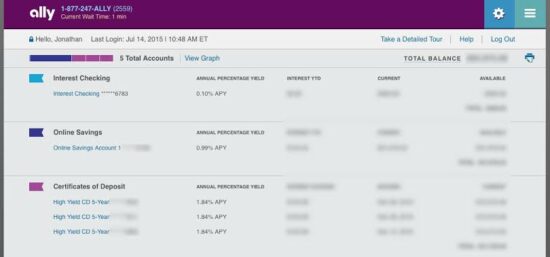

Activating ally.com Card Online

If you prefer using a computer, activating your ally.com Card online is equally straightforward:

- Visit the Ally Bank website.

- Click on “Sign In” at the top right corner.

- Log in with your username and password.

- Navigate to “My Accounts” and select the “Cards” tab.

- Click on “Activate Card” next to your ally.com Card.

- Enter the 16-digit activation code found on your card's back.

- Finalize the activation by clicking “Activate Card”.

This method is beneficial for those who prefer a larger screen or do not have the mobile app installed. It provides a comprehensive overview of your account, detailed transaction history, and allows for easier management of multiple Ally Bank products.

Common Errors During ally.com Card Activation

There are a few common errors that can occur during ally.com Card activation. Here are some solutions to these issues:

- The activation code is incorrect. Make sure you are entering the activation code correctly. The code is usually 16 digits long and is found on the back of your card.

- The card is already activated. If you have already activated your card, you will not be able to activate it again.

- The card is not eligible for activation. If your card is not eligible for activation, you will receive an error message. Contact Ally Bank customer service for more information.

Conclusion

Activating your ally.com card is a straightforward process that unlocks numerous financial benefits. Whether through the mobile app or online, Ally Bank has ensured a user-friendly and efficient activation process.

Should you encounter any issues, customer support is readily available to assist you. With your card activated, you're now ready to enjoy the convenience and advantages it offers in managing your finances.

FAQs

How long does it take for the ally.com card to be activated?

Activation is usually instant once you complete the process either via the mobile app or online.

Can I activate my ally.com card without the mobile app?

Yes, you can activate your card online through Ally Bank's website.

Is there a fee for activating the ally.com card?

No, there is no fee for activating your card.

What should I do if I encounter an error during activation?

Review the instructions to ensure correct steps are followed. For persistent issues, contact Ally Bank customer service.

Can I use my ally.com card immediately after activation?

Yes, the card can be used immediately after successful activation for transactions.